As a startup, one of your most pressing issues is how to get franchise financing for your new car wash. Yes, you might have initial funds for your project, but sooner or later, you’ll find that your savings are not enough. Establishing a business, however small, requires more than just the initial investment. There are fees to pay, related expenses to settle, at a time when your small biz is just gaining steam.

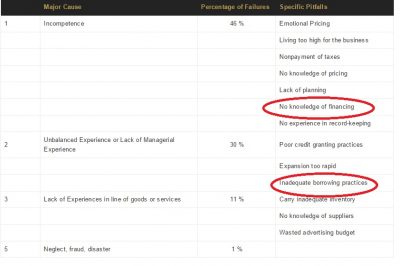

Based on an article written by Neil Patel for Forbes, 90% of startups fail. The lack of financing knowledge and inadequate borrowing practices are, according to Statistics Brain, two of the reasons why.

So, if you want your car wash business to be among the much-desired 10% winning startups, you have to know how to get financing the realistic way.

7 Ways to Get Financing

1. Credit Cards

Though risky, due to their high interest rates, credit cards are still one of the fastest ways to get financing and raise capital for your new car wash business. And once you get your loan, pay on or before your due dates religiously. Ideally, you should pay your monthly balance. If you can’t afford it, then pay more than the minimum. Paying only the minimum amount per month can put you in a very compromising financial situation later on. Here’s a good article on understanding credit card interest.

2. Family and Friends

Who says you cannot borrow from family and friends? You can, but do so in a business-like manner, not as a family conversation. Yes, you can throw your elevator pitch during a reunion, but no more than that. To get financing from the people closest to you, set up an appointment, show your car wash business plan, and let them know what’s in it for them.

3. Join a Franchise to Get Financing

Did you know that investors prefer franchises over independent startups? It’s because they (investors) know that they will be putting their money on first, a proven business formula that can guarantee ROI; second, support and training to ensure the success of the franchisee; and third, a brand image that is already recognized by consumers.

4. Get Financing Through a Bank

If you need get financing for your car wash business, chances are, you will be considering this option. But here’s a thought – bank financing may be popular, but difficult for a startup to get approval, even if you have the required initial capital for buying a business, which is 25% of the build cost. Why? Banks have the following reasons to turn down most applications made by small businesses: increased regulation, a downturn in community banking, and less profits in smaller loans.

But, if you get lucky enough to get a loan from banks, you will have a smaller interest to pay as against other forms of financing. And also, to qualify for SBAs (which is the next option in this list), you will need to apply to banks and get rejected.

5. Small Business Administration (SBA)

Got the thumbs down from banks? You can try to secure an SBA loan. If you qualify, the SBA can bridge you to investors and tell them that yes, through them, you can pay your dues. You’ll have two options under SBA – BA 7(a) or SBA 504 loan. The beauty with SBA loans is that you typically get 90% of the funds you need to purchase a business and payment schedules are not too strict. This is why the SBA is the most popular option for startups.

But getting a loan from SBA is not that easy. First, you have to prove that you are a small business according to their table of small business size standards. Second, you need to show that you have tried but failed to get loans from other financing options. Then, the SBA needs to see proof that you will be using the funds properly. Also, you will need to furnish a lot of paperwork – SBA application, personal background and financial statement, etc. However, given the favorable conditions of the SBA loan you will eventually get financing from, you might find spending the necessary time and efforts quite worth it.

6. Crowdfunding as a Way of Get Financing

The Internet of Things has definitely changed how we live, work, and get financing. Just look at crowdfunding. This financing option was not available a few years ago. However, today you have the chance to get financing from thousands of people across the globe, most of whom you don’t know and might never ever meet. All you need to do is show them that you have a brilliant product or service that has the potential to improves people’s lives and the world.

Kickstarter, Indiegogo, GoFundMe, Crowdrise are some of the best crowdfunding sites out there. The great thing about it? You get to keep the money, meaning you are not obliged to pay your investors back (as opposed to crowdlending, which we will look at in a future post). But before you create a campaign and set a goal, it will be best to learn how to do it well. Otherwise, your campaign – and hopes of getting funds – will disappear into oblivion.

7. Real Estate Equity Loans

Your home can be your door to get financing, but be very careful. Lenders are especially interested in this type of loan because they benefit from it in more ways than one – they get a secure loan, they earn from the interest, and gain more by repossessing your home and reselling it if you default.

So, make sure you do not default if you decide to get financing through Real Estate Equity Loans. Click here to find out how to use this option wisely.

Conclusion

Credit cards, family and friends, joining a franchise, bank financing, SBA loans, crowdfunding, and real estate equity loans are just some options to get financing. Have a solid business plan to present to investors and you will have more chances of acquiring the funds you need.

How about checking the DetailXPerts franchise opportunity? Aside from joining a proven green business model, we help our franchisees secure financing, too.